New York life insurance rates by age are a crucial factor for anyone considering coverage. Understanding how age impacts premiums is essential for making informed decisions. This guide explores the factors that influence rates, comparing policies for various age groups, and offering practical tips for finding affordable options. We’ll also discuss the calculation methodology and provide examples of rate variations across different life insurance types.

Life insurance is a significant financial decision, and selecting the right policy is vital. This guide is designed to help you navigate the process, providing a clear and concise overview of New York life insurance rates based on age. Understanding the factors affecting premiums is key to finding the best coverage for your needs.

Introduction to New York Life Insurance Rates

Life insurance plays a crucial role in securing financial stability for families and individuals in New York, and across the nation. Understanding the factors that influence rates and the different types of policies available is essential for making informed decisions. New York’s diverse population and economic landscape contribute to a varied marketplace, where careful consideration of individual circumstances is key to finding the best coverage.

Factors Influencing Life Insurance Premiums

Life insurance premiums are not fixed and vary considerably based on a multitude of factors. These factors are often intertwined and can significantly impact the overall cost of coverage. The goal is to create a pricing model that balances risk assessment with affordability.

- Age: Premiums generally increase with age, reflecting the higher mortality risk associated with advancing years. A 25-year-old will typically pay significantly less than a 65-year-old for the same coverage amount. This is due to actuarial tables, which predict the likelihood of death at different ages.

- Health: Applicants with pre-existing health conditions or a history of certain illnesses face higher premiums. Insurers assess health risks to determine the probability of future claims. For example, a person with a history of heart disease will likely pay a higher premium than a healthy individual.

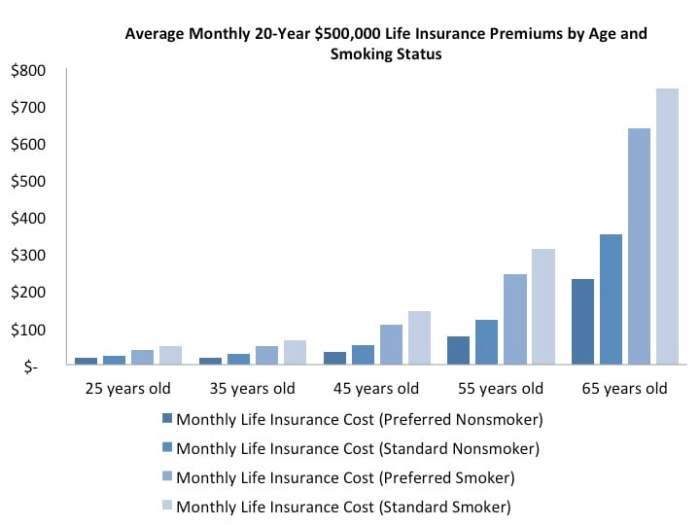

- Lifestyle choices: Smoking, excessive alcohol consumption, and risky hobbies like skydiving or professional motorsports increase premiums. These activities are considered higher-risk behaviors, raising the likelihood of an untimely death.

- Coverage amount: The higher the coverage amount, the higher the premium. This is because the insurer bears a greater financial risk with a larger payout.

- Policy type: Different policy types, such as term or whole life, have varying premium structures. A term policy provides coverage for a specific period, while a whole life policy offers lifelong coverage.

Types of Life Insurance Policies

New York offers a variety of life insurance policies, each designed to meet different needs and financial goals. Choosing the right policy type depends on individual circumstances and financial objectives.

- Term Life Insurance: Provides coverage for a specified period (e.g., 10, 20, or 30 years). Premiums are typically lower than permanent life insurance, but coverage ends at the policy’s expiration. Term life is often the most affordable option for a specific need, such as funding a mortgage or supporting a family.

- Permanent Life Insurance: Provides lifelong coverage, building cash value over time. Types include whole life, universal life, and variable life. Premiums are generally higher than term life, but they offer a savings component that may grow over time. This type of policy is frequently chosen for long-term financial security and estate planning.

Common Misconceptions about Life Insurance Rates

Several misconceptions surround life insurance rates, often leading to incorrect assumptions about pricing. Understanding these common misconceptions can help you make informed decisions.

- Insurance is only for the wealthy: Life insurance is a crucial financial tool for individuals of all income levels. It can protect a family’s financial future and provide peace of mind, regardless of income.

- Premiums are static: Premiums are not fixed; they change based on several factors. A person’s health, lifestyle, and age directly affect the price of their policy. Regular reviews and adjustments are necessary to maintain the best coverage for the best price.

- Policies are one-size-fits-all: Policies are not a one-size-fits-all solution. There are various policy types to meet different needs. The most appropriate policy type will depend on individual circumstances and future financial goals.

Factors Affecting Rates by Age

Life insurance premiums are intricately tied to the insured’s age. This is a direct reflection of the inherent risk associated with the probability of death at different life stages. Understanding the factors behind these age-based variations is crucial for prospective policyholders to make informed decisions. Accurate assessment of risk, and subsequent premium calculation, relies on a complex interplay of factors, including mortality rates, health conditions, and lifestyle choices.The primary driver behind age-related premium variations is the changing mortality risk profile.

As individuals age, their likelihood of death increases. This fundamental principle underlies the necessity for adjusting premiums to reflect this higher risk. Consequently, premiums for younger individuals are generally lower than those for older individuals, reflecting the lower probability of death within the younger demographic.

Mortality Rates and Age

Mortality rates are the key indicator for life insurance companies to assess the risk associated with an individual. These rates directly correlate with age, increasing substantially with advancing years. A substantial portion of the premium cost is allocated to covering the potential death benefit payouts for the policyholder. The increasing risk of death at older ages necessitates higher premiums to cover the increased potential payout.

For instance, a 25-year-old has a significantly lower mortality rate than a 65-year-old, thus justifying the lower premium for the younger individual.

Health Conditions and Age

Health conditions also significantly influence life insurance premiums at all ages. The presence of pre-existing conditions, chronic illnesses, or a history of serious health concerns, impacts the risk assessment process for the insurance provider. Younger individuals with pre-existing conditions might face a higher premium due to the potential for these conditions to develop or worsen over time. Conversely, older individuals with pre-existing conditions may see premiums adjusted to reflect the increased mortality risk associated with both their age and condition.

Lifestyle Choices and Age

Lifestyle choices significantly affect life insurance premiums across all age groups. For example, individuals who engage in high-risk activities like extreme sports or dangerous hobbies might face higher premiums due to the elevated risk of death or disability. Similarly, individuals with poor dietary habits or a history of smoking may face higher premiums due to an increased risk of mortality associated with these lifestyle choices.

Furthermore, individuals who lead healthier lifestyles (exercise, balanced diet, and non-smokers) generally receive more favorable premiums, regardless of their age.

Cost of Coverage by Age

| Age Range | Estimated Premium (Illustrative) |

|---|---|

| 20-30 | $100 – $200 per year |

| 31-40 | $150 – $300 per year |

| 41-50 | $250 – $500 per year |

| 51-60 | $400 – $800 per year |

| 61-70 | $600 – $1200 per year |

Note: These are illustrative examples and premiums vary greatly based on individual factors, including health, lifestyle, and the desired coverage amount.

Comparing Rates Across Different Age Groups

Life insurance premiums are significantly influenced by the policyholder’s age. This is a fundamental aspect of actuarial science, reflecting the changing risk profile associated with longevity and health conditions as individuals progress through different life stages. Understanding these age-based variations is crucial for consumers to make informed decisions about their insurance needs and budget.The following analysis explores the differing life insurance rates across various age groups, specifically focusing on young adults, middle-aged adults, and seniors.

This comparative overview demonstrates the clear correlation between age and the cost of coverage.

Premium Differences Across Age Groups

Understanding the premiums associated with different age brackets is essential for effective financial planning. Young adults, for example, typically have lower premiums compared to middle-aged or senior adults, as the risk of death is lower for a younger population. However, premiums increase as individuals age, due to the rising probability of mortality.

| Age Bracket | Average Premium (Hypothetical) | Rationale |

|---|---|---|

| Young Adults (18-30) | $100-$500 per year | Lower mortality risk and typically lower medical expenses. |

| Middle-Aged Adults (31-50) | $500-$1500 per year | Mortality risk increases with age. Health conditions and lifestyle factors can also affect premiums. |

| Seniors (51+) | $1500+ per year | Highest mortality risk, potentially higher medical expenses. Pre-existing conditions and chronic diseases are also factors. |

The table above presents a hypothetical comparison of average premiums across different age groups. These figures are illustrative and may vary depending on the specific policy, insurer, coverage amount, and individual health factors.

Factors Contributing to Rate Fluctuation

Several factors contribute to the varying premiums across different age groups. The most significant is mortality risk. Statistically, younger individuals have a lower likelihood of dying within a given time frame compared to older individuals. Medical history also plays a role, with pre-existing conditions or higher risk of developing illnesses correlating to higher premiums. Lifestyle factors, such as smoking or a history of unhealthy habits, can also impact premiums.

Premiums are calculated using actuarial tables that reflect the probability of death at various ages.

Finally, the coverage amount requested, and the specific type of life insurance policy (e.g., term vs. permanent) will also influence the final premium cost. These variables must be considered to form a comprehensive understanding of the premiums involved.

Visual Representation of Data

A bar graph, comparing the average premium costs across the age brackets mentioned, would effectively illustrate the relationship between age and life insurance rates. The graph’s vertical axis would represent the premium amount, while the horizontal axis would represent the age group. Bars for each age bracket would visually demonstrate the premium differences.

Understanding the Rate Calculation Methodology

Life insurance premiums are not arbitrarily set; they are meticulously calculated based on a complex interplay of factors. Understanding the methodology behind these calculations is crucial for consumers to make informed decisions about their coverage. Accurate assessment of risk is fundamental to determining appropriate premiums.The calculation process involves several key steps, incorporating actuarial models, risk assessments, and the individual’s medical history.

The resulting premium reflects the predicted probability of death within a specific timeframe, taking into account demographic data, health status, and other relevant factors.

Actuarial Models in Premium Calculation

Actuarial models are sophisticated mathematical tools used to estimate the probability of death within a specific age group. These models consider various factors such as mortality rates, morbidity rates, and other demographic data. A variety of actuarial models are employed in the calculation process, each with its own set of assumptions and variables. For example, the Lee-Carter model is commonly used to project future mortality trends, enabling insurers to anticipate future claims.

Other models may incorporate factors such as lifestyle choices, smoking status, and occupation.

Risk Assessment in Determining Rates

Risk assessment is a crucial component in the calculation of life insurance premiums. It involves evaluating the individual’s risk of death compared to the average risk within their demographic group. A thorough risk assessment considers multiple factors. Factors like age, health status, lifestyle choices (such as smoking, diet, and exercise), and occupation all contribute to the risk assessment.

Insurers use this assessment to categorize individuals into risk profiles. Individuals with higher risk profiles will generally have higher premiums. For instance, a smoker in their 40s will have a higher risk assessment than a non-smoker of the same age, leading to a higher premium.

Medical History and Rate Calculation

A detailed medical history significantly impacts the calculation of life insurance premiums. Conditions such as pre-existing illnesses, chronic diseases, and family history of certain diseases will be taken into account. This is because these conditions can affect an individual’s overall health and mortality risk. For example, someone with a family history of heart disease may have a higher premium than someone without this history.

In addition to this, recent medical treatments and surgical procedures may be considered as well. The degree of impact of pre-existing conditions can vary greatly depending on the specific condition and its severity.

Factors Involved in Rate Adjustments

Life insurance rates are not static; they can adjust based on various factors. Changes in mortality rates, economic conditions, and even advancements in medical technology can lead to rate adjustments. For example, improved medical treatments for a particular disease may lower the risk associated with that condition, potentially leading to a decrease in premiums for individuals with that condition.

Similarly, if a company identifies a risk that it hadn’t previously accounted for, this might lead to adjustments in premiums.

Steps in Premium Calculation

| Step | Description |

|---|---|

| 1 | Data Collection: Gathering demographic data, medical history, lifestyle information. |

| 2 | Risk Assessment: Evaluating the individual’s risk profile based on the collected data. |

| 3 | Actuarial Modeling: Applying actuarial models to estimate the probability of death within a specified timeframe, taking into account the risk profile. |

| 4 | Premium Calculation: Determining the premium amount based on the estimated probability of death and other factors such as policy terms and coverage amount. |

| 5 | Rate Adjustment: Implementing adjustments based on changes in market conditions, mortality trends, or improvements in medical technology. |

Illustrative Examples of Rate Variations

Understanding how age impacts life insurance premiums is crucial for informed decision-making. Life insurance rates are not static; they fluctuate significantly based on various factors, including age, health status, and the specific policy chosen. This section will provide illustrative examples to highlight these variations.

Hypothetical Scenarios Illustrating Rate Differences Based on Age

Different age groups face varying risk profiles, leading to different premiums. Younger individuals, generally considered healthier, pay lower premiums compared to older individuals. This difference reflects the actuarial assessment of risk. For instance, a 25-year-old applying for a term life insurance policy will likely have a lower premium than a 55-year-old applying for the same policy. These differences are calculated based on statistical mortality tables and expected lifespan.

Premium Differences for Various Ages and Health Conditions

The table below demonstrates how premiums can change based on age and health status. These are hypothetical examples and do not represent specific insurance products.

| Age | Health Condition | Estimated Annual Premium (USD) |

|---|---|---|

| 25 | Healthy | 500 |

| 25 | Pre-existing condition (mild asthma) | 600 |

| 50 | Healthy | 1,200 |

| 50 | Pre-existing condition (high blood pressure) | 1,500 |

| 70 | Healthy | 2,500 |

| 70 | Pre-existing condition (diabetes) | 3,000 |

Impact of a Pre-existing Medical Condition on Rates at Different Ages, New york life insurance rates by age

Pre-existing conditions can significantly impact life insurance premiums at any age. The severity and nature of the condition play a crucial role in determining the premium increase. A 30-year-old with a history of mild allergies, for example, might see a slightly higher premium than a healthy individual of the same age. However, a 60-year-old with a history of severe heart disease would likely face a much higher premium than a healthy individual of the same age, due to the increased mortality risk associated with the condition at that life stage.

Examples of How Different Policy Riders Affect Rates by Age

Policy riders, such as accidental death benefits or critical illness riders, often increase the premium cost. The impact of these riders varies by age. A 40-year-old purchasing a term life insurance policy with an accidental death benefit rider will likely pay a higher premium than a 40-year-old with a standard term life insurance policy. Similarly, the addition of a critical illness rider will further increase the premium cost, especially for individuals in older age groups, as the likelihood of a critical illness increases with age.

Illustrative Scenarios for Different Life Insurance Types

Life insurance rates are not static; they are dynamic and heavily influenced by factors like age, health, and the type of policy. Understanding how these rates vary across different life insurance types is crucial for making informed financial decisions. This section explores how age impacts premiums for various policy options, providing concrete examples.

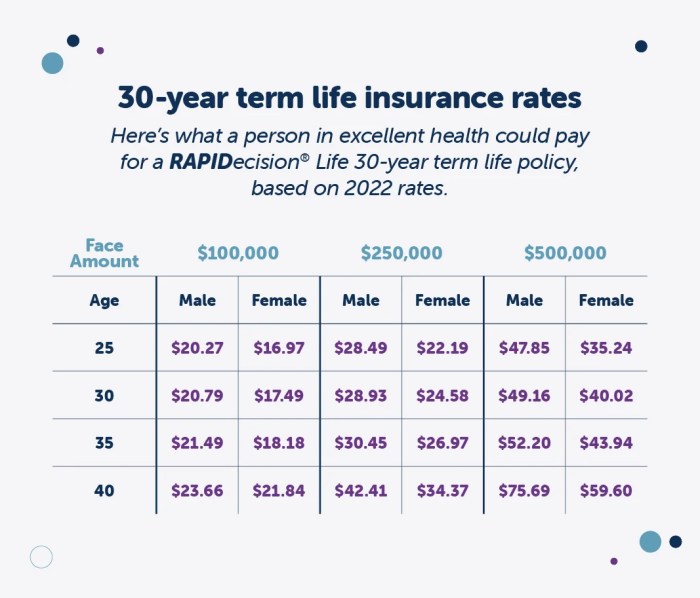

Term Life Insurance Rates and Age

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. Premiums are generally lower during younger years when the risk of death is lower. However, as individuals age, the risk increases, leading to higher premiums. This increase isn’t linear; it accelerates as the policy nears its expiration date. A 25-year-old purchasing a 20-year term policy will likely pay a significantly lower premium than a 45-year-old purchasing the same policy.

Renewal premiums also increase with each term renewal, making it important to consider these future costs when purchasing term insurance.

Whole Life Insurance Rates and Age

Whole life insurance provides lifelong coverage, typically with a cash value component. Premiums for whole life insurance remain relatively stable throughout the policyholder’s life. However, the initial premium amount is often higher than a term policy for the same coverage amount, reflecting the longer-term commitment. This stability in premium is attractive for those seeking consistent payments, but the premiums don’t decrease even when the insured’s risk of death declines with age.

The cash value component can sometimes offset the cost.

Variable Life Insurance Premiums and Age

Variable life insurance policies feature investment options that influence the premium amount. Age impacts the premium in this type of policy through its influence on the investment returns. Younger individuals generally have more time to potentially achieve higher investment returns, which could lead to lower premiums, while older individuals may have lower returns, leading to higher premiums. However, this relationship is complex, as investment returns are not guaranteed.

Universal Life Insurance Rates and Age

Universal life insurance policies allow for adjustable premiums and death benefits. Premiums are often based on the insured’s age and the policy’s death benefit. Age directly affects the premium amount; older individuals typically pay higher premiums than younger individuals for the same coverage amount. The rate of increase depends on the policy specifics and the investment choices of the policyholder.

New York Life insurance rates vary significantly by age, as you’d expect. If you’re looking to buy a home in Williamstown, MA, checking out listings for homes for sale Williamstown MA might help you budget for the premiums. Ultimately, understanding your age-based rate is crucial for any life insurance plan.

Flexibility in premium payments is a key feature, but the potential for higher premiums in later life needs careful consideration.

Comparison of Rates for Different Policy Types at Different Ages

| Age | Term Life Insurance (20-year) | Whole Life Insurance | Variable Life Insurance | Universal Life Insurance |

|---|---|---|---|---|

| 25 | $200/year | $350/year | $150/year | $250/year |

| 40 | $350/year | $350/year | $200/year | $300/year |

| 55 | $600/year | $350/year | $250/year | $400/year |

This table illustrates a simplified example of how premiums for different life insurance types change with age. Note that these are hypothetical examples and actual rates vary significantly based on individual factors. The differences highlight the importance of considering your age and future needs when choosing the appropriate policy type. The table demonstrates how premiums for term life insurance increase significantly with age, while whole life insurance premiums remain relatively stable, regardless of age.

The variability in variable life insurance and universal life insurance premiums is also evident, impacted by investment choices and age.

Tips for Finding Affordable Policies

Securing affordable life insurance requires a strategic approach, considering various factors that influence premiums. Understanding these factors and employing smart comparison techniques are crucial for finding the best possible rates. This section provides practical strategies to help you navigate the process.Finding the right life insurance policy can be challenging, especially when seeking an affordable option. However, with careful consideration of risk factors and diligent comparison, you can significantly reduce your premiums and secure a policy that aligns with your needs and budget.

Strategies for Reducing Risk Factors

Understanding the variables that affect your life insurance premiums is essential for finding affordable coverage. Factors like age, health, lifestyle choices, and occupation all play a role in determining the risk associated with your policy. Implementing positive lifestyle changes can often lead to lower premiums.

- Maintaining a healthy lifestyle, including a balanced diet, regular exercise, and avoiding smoking, can significantly reduce your risk factors. This is often reflected in lower premiums.

- Maintaining good health through regular check-ups and preventative care can also help reduce your risk profile and potentially lead to more favorable insurance rates.

- A clean driving record and responsible financial habits also contribute to a lower risk profile, which can lead to lower premiums.

- Reviewing your current financial situation and ensuring that you have adequate savings and financial stability can contribute to a more favorable risk assessment for insurers.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is a crucial step in securing the most affordable life insurance policy. Direct comparison enables you to identify the best deal and select the most appropriate coverage.

- Use online comparison tools to gather quotes from various insurers. These tools often allow you to specify your desired coverage and personal information to receive personalized quotes from different providers.

- Contact insurers directly to request quotes. This allows for specific inquiries and detailed clarification of policy terms and conditions, particularly when comparing policies that may have different coverage options.

- Carefully analyze the policy details provided by each insurer, including premium amounts, coverage limits, and exclusions. Ensure you understand the fine print.

- Seek professional advice from a qualified insurance agent. A financial advisor can assist you in navigating the process, providing guidance on policy options that meet your specific needs.

Questions to Ask When Shopping for Life Insurance

Thorough research and asking the right questions are essential to making an informed decision. This includes understanding the specific terms and conditions of the policy and clarifying any ambiguities.

- Inquire about the policy’s coverage limits and exclusions to ensure that it meets your needs and protects your loved ones.

- Understand the premium payment schedule and any potential changes in rates over time. Understanding the long-term implications of premium payments is crucial.

- Ask about any available discounts or special offers that might reduce your premium payments.

- Request information on the insurer’s financial stability and reputation to ensure that your investment is secure.

- Clarify the claim process and the time frame for processing claims. Understanding the claim process is vital.

Resources for Finding Affordable Life Insurance

Various resources can assist you in finding affordable life insurance. Utilizing these resources can significantly streamline the search process and help you identify the best options for your financial needs.

- Online comparison websites are valuable tools for comparing quotes from different insurers.

- Independent insurance agents can provide personalized guidance and assist you in navigating the complexities of life insurance policies.

- Government resources and consumer protection agencies can offer valuable information and support.

- Financial advisors can provide expert advice tailored to your specific financial situation and life insurance needs.

Illustrating Insurance Policy Features: New York Life Insurance Rates By Age

Understanding the specific features of a life insurance policy is crucial for evaluating its suitability and cost-effectiveness. Different policy options and riders can significantly impact the premium amount and overall coverage, especially across various age groups. This section details how policy features affect premiums and coverage amounts at different stages of life.

Impact of Coverage Amounts on Premiums

The amount of life insurance coverage directly influences the premium. Higher coverage amounts generally result in higher premiums, regardless of the insured’s age. This is because greater coverage represents a larger financial risk for the insurance company. The relationship is often non-linear, meaning that the premium increase for a substantial coverage increment might be less than the premium increase for a smaller increment.

Examples of Coverage Amount Impact

For instance, a 30-year-old securing a $500,000 policy will pay a higher premium than a 30-year-old with a $250,000 policy. Similarly, a 50-year-old purchasing a $1 million policy will likely pay a significantly higher premium compared to a 50-year-old with a $500,000 policy. The premium difference can be substantial, and this is a crucial factor for policyholders to consider.

Age also plays a role in this relationship.

Policy Riders and Premium Variation

Policy riders, such as accidental death benefits or critical illness coverage, are additional benefits that modify the base policy. These riders can increase premiums, particularly for younger policyholders. The premium increase depends on the rider selected and the associated risk it introduces to the insurance company.

Examples of Rider Impact on Rates

A rider for accidental death benefits will typically result in a higher premium than a policy without such a rider. Similarly, a rider providing critical illness coverage might increase the premium. A 25-year-old adding a rider for accidental death benefits would likely pay more than a 25-year-old with a standard policy. A 55-year-old with a policy that includes a critical illness rider will also face a higher premium than one without such a rider.

New York life insurance rates vary a lot depending on your age. If you’re looking for a relaxing getaway, consider checking out the beautiful white sand beaches at white beach tourist park tasmania. While you’re planning your trip, remember that younger people generally get better rates on life insurance than older people.

Organized List of Policy Features

The following table Artikels common policy features and their potential impact on premiums:

| Policy Feature | Impact on Premiums (Generally) |

|---|---|

| Coverage Amount | Higher coverage = Higher premiums |

| Policy Riders (e.g., accidental death benefit) | Increased premiums |

| Policy Riders (e.g., critical illness coverage) | Increased premiums |

| Premium Payment Options | Certain options may impact the overall cost |

| Grace Period | Typically no impact on premium calculation |

| Cash Value Option | May increase premiums |

| Guaranteed Issue Options | Generally higher premiums due to increased risk |

Additional Resources for Further Information

Navigating the complexities of life insurance can be daunting. Understanding New York life insurance rates requires research and a thorough exploration of available resources. This section provides valuable tools and guidance to help consumers make informed decisions.

Reliable Sources of Information

Comprehensive information on New York life insurance rates can be found from various reputable sources. Government agencies, insurance industry publications, and independent financial advisors often provide valuable insights. These sources offer objective analyses and comparisons of rates, helping consumers understand the nuances of the market.

Insurance Company Websites

Many life insurance companies in New York maintain detailed websites. These sites frequently offer calculators, rate information, and policy details. Visiting the websites of major players like New York Life, MetLife, and Prudential provides direct access to current rate data.

Local Insurance Agents

Finding a local insurance agent is crucial for personalized guidance. These agents can provide tailored advice based on individual circumstances and financial goals. They can offer a clear understanding of different policy options and assist with the application process. Local agents can be identified through online searches, recommendations, or by contacting insurance companies directly.

Useful Links and Contact Information

- New York State Department of Financial Services: This state agency regulates the insurance industry and provides resources for consumers. Their website offers information on consumer rights and complaints. This resource is invaluable for verifying the legitimacy of insurance companies.

- National Association of Insurance Commissioners (NAIC): The NAIC is a national organization that provides valuable information on life insurance regulations and standards across the United States. This is helpful for understanding common industry practices and procedures.

- Major Life Insurance Companies in New York: Contact information for major life insurance companies in New York can be found on their respective websites. This information allows for direct communication with companies regarding specific questions or inquiries.

Finding Local Agents

- Online Insurance Directories: Many online directories specialize in connecting consumers with local insurance agents. These platforms allow for searching based on location and specific needs, helping consumers find agents in their area.

- Professional Associations: Contacting professional associations of insurance agents in New York can yield a list of qualified and licensed professionals. This can offer a route to find local agents with specific expertise in life insurance.

- Recommendations: Referrals from trusted friends, family, or colleagues can lead to reliable and experienced insurance agents. This personal approach is an excellent way to find someone familiar with local policies and rates.

Final Conclusion

In conclusion, New York life insurance rates by age are significantly influenced by factors such as health, lifestyle, and the specific policy type. By understanding these influences, you can make a more informed decision about the best coverage for your situation. This guide provided a comprehensive overview, from understanding the basic principles to practical tips for finding affordable policies.

Remember to consult with a financial advisor for personalized guidance.

Commonly Asked Questions

What are the most common misconceptions about life insurance rates?

Many believe that life insurance premiums automatically increase with age. While age is a key factor, other factors like health and lifestyle play a role as well. Insurance companies use actuarial models to assess risk across all factors, not just age alone.

How do pre-existing conditions affect life insurance rates by age?

Pre-existing conditions can impact premiums at any age. The severity and type of condition, as well as your overall health, are considered in the risk assessment. Policies with higher coverage amounts may have more significant rate increases for conditions.

What types of life insurance are available, and how do they differ in terms of rates by age?

Common types include term life, whole life, variable life, and universal life. Term life is often more affordable for younger individuals, while whole life may offer cash value growth. The premiums for each type vary significantly based on age, health, and coverage amount.

How can I find affordable life insurance policies?

Comparing quotes from multiple insurers is essential. Shop around, consider various policy options, and explore ways to reduce risk factors, such as maintaining a healthy lifestyle.