Fremont Bank home equity line of credit rates present a complex landscape for potential borrowers. This analysis delves into the intricate factors shaping these rates, providing a critical overview of the institution’s offerings. The study considers market trends, competitive landscapes, and individual borrower profiles to offer a comprehensive understanding of the intricacies of HELOC financing.

The analysis begins by defining HELOCs, exploring their purpose and function. It then examines the key factors influencing rates, including credit scores, loan amounts, and market conditions. A comparison with competitor offerings highlights the strengths and weaknesses of Fremont Bank’s HELOC options, considering fees, terms, and promotions. The study also addresses current market trends, analyzing their impact on rates and availability.

Overview of Fremont Bank Home Equity Line of Credit (HELOC) Rates

Yo, peeps! Fremont Bank’s HELOC rates are a hot topic, right? We’re gonna break down what HELOCs are, what makes those rates move, and what Fremont Bank’s offering. Get ready to level up your financial knowledge!HELOCs are basically like a credit line you can tap into using your home as collateral. Think of it as a revolving credit card, but secured by your house.

You can borrow money as needed up to a certain limit, and pay it back over time, just like a loan. The beauty is, you can access funds flexibly whenever you need them, unlike a traditional mortgage.

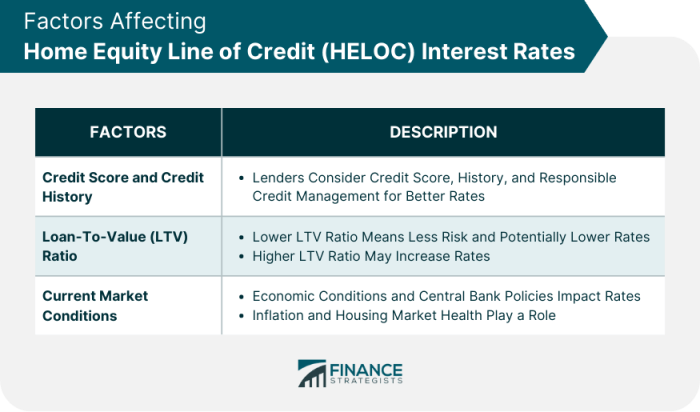

Factors Influencing HELOC Rates

Understanding what affects those HELOC interest rates is key. It’s not just about the bank’s whim. A bunch of things play a role, and they all impact the rate you get.

| Factor | Description | Impact on Rate |

|---|---|---|

| Credit Score | Your creditworthiness, a reflection of your payment history. | Higher credit scores generally lead to lower rates. Think of it like a good credit score is a golden ticket to a better deal. |

| Loan Amount | The total amount you’re borrowing. | Larger loan amounts usually come with higher rates. It’s like buying a bigger house—you’re taking on more risk, so the rate reflects that. |

| Market Conditions | Overall interest rates in the market, influenced by things like the economy and inflation. | Fluctuations in the market greatly affect rates. If rates go up, HELOC rates usually go up too. Think of it as a ripple effect. |

| Loan Term | The period you have to repay the loan. | Longer terms usually mean slightly higher rates, as the bank takes on more risk. |

| Type of HELOC | Fixed-rate or adjustable-rate. | Fixed-rate HELOCs provide a steady interest rate, while adjustable-rate HELOCs change with market conditions. |

Types of HELOCs Offered by Fremont Bank

Fremont Bank likely offers both fixed-rate and adjustable-rate HELOCs. A fixed-rate HELOC keeps your interest rate constant throughout the loan term. This is great for stability, but it might mean a higher rate initially. An adjustable-rate HELOC, on the other hand, has a rate that can change based on market conditions. This could save you money initially, but it’s important to be aware that your rate could increase.

Both have their pros and cons.

Historical Trends of HELOC Rates

HELOC rates have fluctuated a lot over the years. Back in the pre-2008 era, rates were often lower. However, since then, they’ve seen periods of both increases and decreases, depending on market conditions. It’s like a rollercoaster ride—sometimes up, sometimes down. You gotta keep an eye on the market.

Comparison of Fremont Bank HELOC Rates with Competitors

Yo, peeps! So, we’ve got the Fremont Bank HELOC rates, but how do they stack up against other banks in town? Let’s break it down, see who’s offering the best deals, and maybe find some sweet spots for you.This comparison dives into the nitty-gritty of Fremont Bank’s HELOCs, looking at their rates, fees, and terms alongside major competitors.

We’ll also see how your personal situation might affect your HELOC deal at Fremont Bank. Basically, we’re tryna help you make the smartest financial move for your home improvement projects.

Rate Comparison with Major Competitors

Checking out rates from other banks is crucial to see where Fremont Bank fits in the picture. It’s like comparing prices at different shops—you want the best deal, right? Different banks often have different pricing strategies, and these rates can vary widely depending on factors like your credit score and the loan amount.

Fremont Bank’s home equity line of credit rates are looking pretty competitive right now. If you’re thinking about building a new home or just want a little extra cash, it’s worth checking out their options. While you’re browsing, you might want to check out some fun Christmas gingerbread house coloring pages to get you in the holiday spirit.

Christmas gingerbread house coloring pages can be a great way to unwind and get into the festive mood. Ultimately, if you’re considering a home equity line of credit, it’s crucial to compare rates carefully.

| Bank | Interest Rate (Example) | Fees (Example) | Loan Terms |

|---|---|---|---|

| Fremont Bank | 6.5% – 8.5% (APR) | Origination Fee: 1%, Appraisal Fee: $500 | 10-25 years |

| Bank A | 6.0% – 8.0% (APR) | Origination Fee: 1.5%, Appraisal Fee: $450 | 10-20 years |

| Bank B | 6.2% – 8.8% (APR) | Origination Fee: 0.5%, Appraisal Fee: $600 | 12-30 years |

Note: Rates and fees are examples and may vary based on individual circumstances.

Impact of Customer Profile on HELOC Rates

Your personal financial situation definitely plays a role in your HELOC rate at Fremont Bank, just like with other banks. Things like your credit score, the amount you’re borrowing, and even your loan history can all affect the interest rate you’re offered. Higher credit scores usually get you better rates. Also, bigger loan amounts might mean higher rates.

It’s all about balancing the risks for the lender.

Promotions and Incentives Offered by Fremont Bank

Sometimes, Fremont Bank throws in some extra goodies to sweeten the deal. These could be special promotional rates for a limited time, or maybe a little something extra to incentivize you to choose their HELOC. Keep an eye out for these deals; they can save you some serious cash. For instance, they might offer a lower interest rate for the first year, or a free appraisal.

It’s always a good idea to ask about any current promotions.

Current Market Trends Affecting HELOC Rates: Fremont Bank Home Equity Line Of Credit Rates

Wih market gon’ crazy, HELOC rates are like a rollercoaster, yo. Interest rates are affected by a bunch of things, from inflation to lending rules. It’s all about the economic climate, so let’s dive into the deets.The current economic climate is a major factor influencing HELOC rates. High inflation and rising interest rates on other loans are putting pressure on HELOCs.

This is making it tougher to get a good rate, because banks are being extra careful with their money. Plus, there’s a lot of uncertainty in the market, which makes it harder to predict what’s coming next.

Economic Conditions and HELOC Interest Rates

Current economic conditions are impacting HELOC rates in a big way. High inflation is making borrowing costs go up, and that directly affects the rates offered by banks. Think of it like this: if everything’s getting more expensive, then borrowing money becomes more costly. The Federal Reserve’s efforts to tame inflation also contribute to the rise in borrowing costs.

The Fed’s actions affect the overall interest rate environment, which in turn influences HELOC rates.

Changes in Lending Regulations

Lending regulations have changed recently, and these changes are impacting HELOC rates. Lenders are more cautious now, which means they’re tightening up their requirements. This is especially true for borrowers with less-than-stellar credit scores. They might have to provide more collateral, or the approval process might take longer. Basically, banks are playing it safe, which is impacting HELOC availability and rates.

Impact of Inflation and Other Economic Factors

Inflation is a major player in the current market trends affecting HELOC rates. Higher inflation usually means higher interest rates, which makes it more expensive to borrow money. Other economic factors, like the state of the housing market, also play a role. A slow housing market might lead to less demand for HELOCs, which could cause rates to go down, but it’s tricky to say for sure.

The overall economic outlook is crucial for predicting HELOC rates.

Impact on HELOC Availability

Availability of HELOCs is affected by the current market conditions. Banks are being more selective about who they lend to, and that’s making it tougher for some borrowers to get approved. There’s also a greater demand for HELOCs right now, so that could be pushing rates up. Overall, getting a HELOC right now might be a little harder than it used to be.

Summary Table: Impact of Factors on HELOC Rates

| Factor | Impact on HELOC Rates |

|---|---|

| High Inflation | Higher rates, making HELOCs more expensive |

| Rising Interest Rates | Higher rates, making HELOCs more expensive |

| Tightened Lending Regulations | Reduced availability, potentially higher rates for some borrowers |

| Slow Housing Market | Potentially lower rates, reduced demand for HELOCs |

| Uncertainty in the Market | Increased risk for lenders, potentially higher rates or reduced availability |

Factors Influencing Individual HELOC Rate Quotes

Getting a HELOC rate in Fremont Bank, or any bank for that matter, ain’t just about the general market rate. It’s a whole personalized thing, man. Your credit score, how much you borrow, and even your financial history all play a role in the final number. It’s like a tailor-made suit – it fits you perfectly, but not everyone gets the same cut.

Credit Score Impact

Your credit score is the big kahuna when it comes to HELOC rates. A higher score usually means a lower rate, because you’re seen as a less risky borrower. Think of it like this: a good credit score shows the bank you’re responsible with your money, so they’re more willing to give you a sweet deal on the interest rate.

Conversely, a low score might mean a higher rate because the bank sees you as a bigger risk.

Loan Amount and Loan-to-Value Ratio (LTV)

The amount you’re borrowing and the LTV ratio are key factors too. A bigger loan generally means a higher rate, as the bank’s risk increases. The LTV ratio, which is the loan amount compared to the home’s value, also matters. A lower LTV usually means a better rate, because the bank is less worried about you defaulting.

If you’re borrowing close to the home’s worth, the bank sees more risk and might charge you a higher rate.

Underwriting Process Variations

Different HELOC applications have slightly different underwriting processes. It’s not a one-size-fits-all deal. For instance, if you’re a first-time homebuyer, the bank might look at your application a bit differently, considering factors like your stability and income. They might need more information from you to feel confident about your ability to repay the loan.

Financial History and Stability

Your overall financial history – including your income, employment, and debt-to-income ratio – significantly impacts your rate. A steady income and a low debt-to-income ratio show the bank that you can comfortably manage the loan payments, thus reducing the risk for them. If your income is inconsistent or you have a high level of debt, your rate will likely be higher.

Impact of Down Payment Amount

The down payment amount is directly related to the LTV. A larger down payment translates to a lower LTV, making you a less risky borrower. The bank will likely offer a more favorable rate if you have a bigger down payment.

Table of Factors Influencing HELOC Rates

| Factor | Impact on HELOC Quote |

|---|---|

| Credit Score | Higher score = Lower rate; Lower score = Higher rate |

| Loan Amount | Larger loan amount = Higher rate |

| Loan-to-Value Ratio (LTV) | Lower LTV = Lower rate; Higher LTV = Higher rate |

| Underwriting Process | Specific criteria and documentation requirements may vary depending on the application type. |

| Financial History & Stability | Consistent income and low debt = Lower rate; Inconsistent income or high debt = Higher rate |

| Down Payment Amount | Larger down payment = Lower rate |

Strategies for Securing Favorable HELOC Rates

Getting a good HELOC rate is key, like getting a sweet deal on a new gadget. It’s all about smart moves and knowing the ropes. This section breaks down how to nail those rates, so you can snag the best possible terms.Understanding your credit score and creditworthiness is super important. A higher score usually means a lower interest rate.

Think of it like a good reputation – the better it is, the more favorable the terms.

Improving Credit Score and Creditworthiness

Maintaining a healthy credit score is crucial for a better HELOC rate. Paying bills on time and keeping credit utilization low are two major factors. Don’t max out your credit cards; keep them at a reasonable level to show you’re responsible. Checking your credit report regularly for errors is also a good idea. If you find any inaccuracies, dispute them right away.

This way, you’re building a solid financial profile, which translates to better rates.

Shopping for the Best HELOC Rates

Don’t just settle for the first HELOC offer you get. Shop around like you’re hunting for the perfect deal on a new phone. Compare rates from different lenders. Look at things like interest rates, fees, and repayment terms. Websites dedicated to comparing financial products can be a huge help.

Using a comparison tool can make it easier to compare various options and find the best deal for your needs.

Negotiating HELOC Terms and Rates

Don’t be afraid to negotiate your HELOC terms. After you’ve got your offers, consider what works best for your financial situation. If you’re confident about your financial standing and you’ve got a strong track record, you can discuss your circumstances with the lender to see if they’re willing to adjust the rate. Remember, communication is key! Explain your financial situation, and why the offered rate isn’t ideal for you.

Be polite and professional.

Understanding Loan Documents and Fees

Carefully review all loan documents before signing. This is not just about the interest rate; you need to know the fine print. Pay attention to fees like origination fees, closing costs, and any prepayment penalties. Don’t be afraid to ask questions if something isn’t clear. Make sure you understand the complete terms before committing to the loan.

Get a second opinion if necessary.

Fremont Bank’s home equity line of credit rates are looking pretty good right now, but before you dive in, consider what kind of feline companion you might want to match with your new financial freedom. Choosing the best breed for house cat can significantly impact your home life. For instance, a playful breed might require more attention, which could influence your ability to manage repayments.

Ultimately, understanding the nuances of Fremont Bank’s rates will help you make the right financial decisions. best breed for house cat

Illustrative Example of HELOC Rate Calculation

Nih, contoh nyata soal perhitungan suku bunga HELOC. Bayangin aja, mau ambil HELOC di Fremont Bank buat renovasi rumah. Faktor-faktor kayak kredit rating, jumlah pinjaman, dan kondisi pasar saat itu, semuanya bakalan ngaruh ke suku bunganya.Nah, sekarang kita liat gimana sih perhitungannya. Kita akan bahas detail gimana masing-masing faktor itu mempengaruhi rate HELOC-mu. Ini bukan cuma teori, tapi contoh nyata yang bisa dipahami semua orang.

Factors Influencing HELOC Rate

Berbagai faktor mempengaruhi suku bunga HELOC, mulai dari poin-poin keuangan pribadi sampe kondisi pasar. Faktor-faktor ini saling terhubung dan bakalan ngaruh ke keputusan akhirnya. Berikut poin-poinnya:

- Credit Score: Semakin tinggi kredit score-mu, semakin rendah suku bunga yang bakal kamu dapetin. Bayangin aja, kalo kamu punya riwayat pembayaran yang konsisten dan bagus, bank bakal lebih percaya sama kemampuan kamu buat ngebayar utang. Ini kayak bonus diskon buat kamu, bro!

- Loan Amount: Besar pinjaman juga bakalan ngaruh. Kalo kamu minjem duit banyak, risiko buat bank juga makin gede. Makanya, biasanya bank bakal ngasih suku bunga yang lebih tinggi buat pinjaman besar.

- Loan Term: Lama pinjaman juga penting. Kalo kamu mau ngambil HELOC buat jangka waktu yang panjang, biasanya bank bakal ngasih suku bunga yang lebih tinggi daripada yang jangka pendek. Ini kayak bunga deposito, semakin lama, semakin besar.

- Market Conditions: Kondisi pasar keuangan saat itu juga bakalan ngaruh. Kalo kondisi pasar lagi naik, biasanya suku bunga juga naik. Kalo lagi turun, suku bunga juga bisa turun. Ini kayak naik turunnya harga saham, ya.

Detailed Breakdown of the Calculation Process

Berikut breakdown detail proses perhitungan HELOC rate. Ini penting banget buat kamu pahami, supaya ga kebingungan.

Suku bunga HELOC biasanya didasarkan pada suku bunga acuan (misalnya suku bunga deposito) ditambah dengan margin bank.

- Base Rate: Suku bunga acuan yang ditentukan oleh bank, jadi kayak patokan awal.

- Margin: Tambahan yang ditambahkan ke base rate. Ini ditentukan berdasarkan risiko bank, kondisi pasar, dan profil kredit kamu. Makin tinggi risikonya, makin tinggi marginnya.

- Credit Score Adjustment: Penyesuaian suku bunga berdasarkan kredit score kamu. Semakin tinggi credit score, semakin kecil penyesuaiannya, jadi suku bunga lebih rendah.

- Loan Amount Adjustment: Penyesuaian suku bunga berdasarkan jumlah pinjaman. Makin besar pinjaman, makin tinggi penyesuaiannya, jadi suku bunga lebih tinggi.

Illustrative Scenario

Misalnya, Budi mau ambil HELOC Rp100 juta di Fremont Bank. Berikut breakdown detail perhitungannya:

| Faktor | Nilai | Pengaruh |

|---|---|---|

| Base Rate | 8% | Suku bunga acuan |

| Margin | 2% | Tambahan risiko |

| Credit Score Adjustment | -0.5% | Diskon karena credit score bagus |

| Loan Amount Adjustment | +0.3% | Penyesuaian karena jumlah pinjaman |

| Total Rate | 9.8% | Suku bunga akhir |

Amortization Schedule, Fremont bank home equity line of credit rates

Amortization schedule memperlihatkan bagaimana pembayaran pokok dan bunga berubah seiring waktu.

Ini diagram yang memperlihatkan grafik suku bunga dan pembayaran pokok seiring waktu, dari awal hingga akhir periode pinjaman. Bisa dilihat bagaimana pembayaran pokok meningkat seiring waktu, sementara pembayaran bunga menurun. Grafik ini membantu memperlihatkan bagaimana perubahan rate bisa memengaruhi jumlah cicilan bulanan.

Final Thoughts

In conclusion, navigating Fremont Bank home equity line of credit rates requires a nuanced understanding of various factors. The study demonstrates how individual circumstances and market dynamics significantly impact the final rate. Strategies for securing favorable rates are presented, alongside a detailed example illustrating the calculation process. Ultimately, a thorough analysis reveals the intricate balance between lender offerings and borrower profiles in determining the optimal HELOC solution.

FAQ Compilation

What are the typical fees associated with a Fremont Bank HELOC?

Fremont Bank HELOCs typically involve origination fees, annual fees, and potential prepayment penalties. Specific fees vary depending on the loan amount, terms, and the individual borrower’s circumstances.

How does my credit score affect my HELOC rate at Fremont Bank?

A higher credit score generally translates to a lower interest rate. Fremont Bank, like most lenders, utilizes credit scores as a significant factor in determining the risk associated with a HELOC application.

What is the difference between a fixed-rate and an adjustable-rate HELOC?

Fixed-rate HELOCs maintain a constant interest rate throughout the loan term, while adjustable-rate HELOCs fluctuate based on market indices. The choice depends on the borrower’s risk tolerance and anticipated financial conditions.

How long is the draw period for a Fremont Bank HELOC?

The draw period for a Fremont Bank HELOC is the time frame during which the borrower can access funds from the line of credit. This period is typically specified in the loan agreement.