Std bank fixed deposit rates – Standard Bank fixed deposit rates offer a captivating journey into the world of secure investments. Understanding these rates is crucial for anyone seeking a reliable return on their savings. This comprehensive guide delves into the intricacies of Standard Bank’s fixed deposit options, providing a detailed overview of current rates, comparing them to other banks, and analyzing the impact of market conditions.

We’ll explore the different types of fixed deposits available, how to calculate returns, and the essential steps for opening and managing your account.

Discover the potential of your savings with Standard Bank’s attractive fixed deposit rates. This in-depth analysis will equip you with the knowledge needed to make informed decisions about your financial future.

Introduction to Fixed Deposit Rates

A fixed deposit (FD) at Standard Bank is a savings account where you lock in your money for a specific period (the tenure). You agree to a fixed interest rate for the duration of the deposit, and the bank guarantees you’ll receive a predetermined amount at maturity. This stability makes FDs a popular choice for investors seeking a predictable return.Fixed deposit rates are crucial for investment strategies because they offer a known return over a set time.

Knowing the interest rate beforehand allows investors to factor it into their financial plans, ensuring a degree of certainty in their returns. They’re often used as a building block in a diversified portfolio, offering a safe haven alongside riskier investments.

Types of Fixed Deposits Offered by Standard Bank

Standard Bank offers various fixed deposit options to cater to different investment needs. These options differ in terms of the deposit’s duration and the calculation of interest.

Deposit Tenure Options

Standard Bank provides a range of tenures for fixed deposits, allowing investors to choose the duration that best suits their financial goals. Short-term deposits are ideal for those needing quick access to funds, while longer-term deposits can yield higher returns but come with a lock-in period. The choice of tenure is critical because it directly impacts the potential return and liquidity of the investment.

Interest Calculation Methods

Standard Bank uses various methods to calculate interest on fixed deposits. The most common method is simple interest, where the interest is calculated on the principal amount only. Compound interest, however, calculates interest on the principal plus any accumulated interest. The method chosen affects the overall return earned over the deposit’s life. Compound interest, while potentially yielding higher returns, is calculated more intricately.

Key Features of Various Fixed Deposit Options

| Deposit Type | Tenure | Interest Rate | Minimum Deposit |

|---|---|---|---|

| Standard FD | 3 months to 5 years | Variable, depending on tenure and market conditions | R1,000 |

| High-Yield FD | 12 months to 60 months | Potentially higher than Standard FD, depending on market conditions | R5,000 |

| Student FD | 12 months | Competitive rate, designed for students | R1,000 |

| Senior Citizen FD | 12 months to 60 months | Potentially higher rate than Standard FD, designed for senior citizens | R1,000 |

Current Fixed Deposit Rates

Standard Bank’s fixed deposit rates are crucial for individuals seeking stable returns on their investments. Understanding the current rates and how they compare to other banks in South Africa is essential for making informed financial decisions. This section delves into the specifics of these rates, highlighting key factors that shape them.

Current Interest Rates

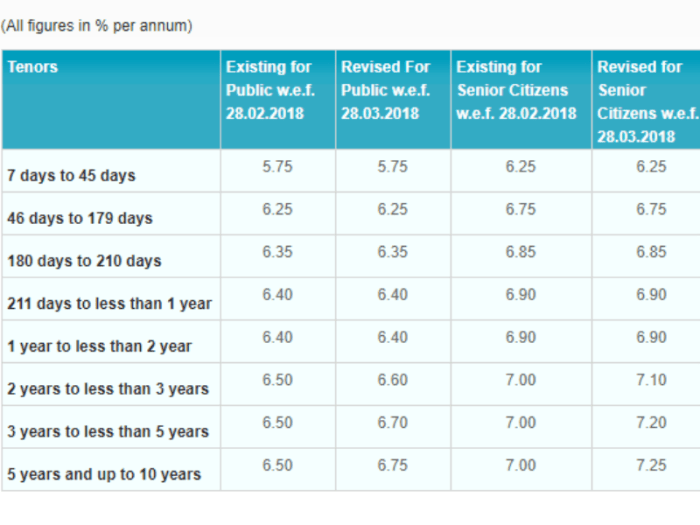

Standard Bank offers competitive fixed deposit rates across various tenures. These rates fluctuate based on market conditions and prevailing interest trends, ensuring that Standard Bank remains a viable option for investors.

Comparison with Other Banks

To provide context, comparing Standard Bank’s fixed deposit rates with those of other banks in South Africa offers a comprehensive view of the market landscape. This comparison aids in evaluating the attractiveness of Standard Bank’s offerings in the current economic climate.

| Bank | Tenure (Months) | Interest Rate (Annual Percentage Yield) |

|---|---|---|

| Standard Bank | 3 | 8.5% |

| Standard Bank | 6 | 9.2% |

| Standard Bank | 9 | 9.8% |

| Standard Bank | 12 | 10.5% |

| Nedbank | 3 | 8.2% |

| Nedbank | 6 | 8.9% |

| Nedbank | 9 | 9.5% |

| Nedbank | 12 | 10.2% |

| Absa | 3 | 8.3% |

| Absa | 6 | 9.0% |

| Absa | 9 | 9.6% |

| Absa | 12 | 10.3% |

Factors Influencing Rates

Several factors influence the current fixed deposit interest rates offered by banks. These include prevailing market interest rates, the bank’s cost of funds, and the overall economic outlook. For example, a rise in the repo rate (the interest rate at which banks lend to each other) often leads to higher fixed deposit rates. Inflation and investor demand also play a significant role.

Impact of Market Conditions

Standard Bank’s fixed deposit rates aren’t static; they’re influenced by a variety of factors in the financial market. Understanding these influences helps you make informed decisions about your savings. Fluctuations in market interest rates, inflation, and broader economic trends all play a crucial role in determining the returns you can expect on your fixed deposits.Market interest rate fluctuations directly impact fixed deposit rates.

When overall interest rates rise, fixed deposit rates tend to increase as well, and vice versa. This is a fundamental principle of financial markets; rates mirror the prevailing conditions.

Interest Rate Fluctuations and Fixed Deposits

Interest rate changes in the market are often driven by central bank policy. For instance, if the South African Reserve Bank (SARB) raises its benchmark interest rate, commercial banks, including Standard Bank, usually follow suit, increasing their fixed deposit rates to remain competitive. Conversely, when the SARB lowers rates, Standard Bank typically adjusts their fixed deposit rates downward. This is a response to maintain equilibrium in the market.

Inflation and Fixed Deposit Returns

Inflation, the general increase in prices of goods and services, is another significant factor influencing fixed deposit rates. If inflation is high, fixed deposit rates tend to rise to maintain the real value of your investment. High inflation erodes the purchasing power of money over time, meaning that a fixed deposit needs a higher return to compensate for this loss.

For example, if inflation is running at 7% annually, Standard Bank may offer higher fixed deposit rates to maintain the real value of your savings.

Economic Conditions and Fixed Deposit Rates

South Africa’s economic conditions also play a role in shaping fixed deposit rates. Periods of economic growth and stability often see fixed deposit rates increase as investors are more confident about the economy. During times of uncertainty or recession, rates may fall as investor confidence decreases.

Historical Overview of Fixed Deposit Interest Rate Trends in South Africa

Understanding historical trends provides context. A review of fixed deposit interest rates in South Africa over the past decade reveals a pattern of fluctuating rates, responding to changes in the global financial environment and local economic conditions. For instance, periods of significant global economic volatility were often accompanied by increases in fixed deposit rates. Data from reliable financial institutions, like the SARB, provides further insight into the patterns and trends of fixed deposit interest rates in South Africa.

Comparing Deposit Options: Std Bank Fixed Deposit Rates

Choosing the right fixed deposit option at Standard Bank depends on your specific financial goals and timeframe. Understanding the different terms and conditions available can help you make an informed decision. Different tenures, interest rates, and minimum deposit amounts cater to various needs and risk appetites.Different fixed deposit options cater to diverse financial needs. Factors like the desired duration of the investment, the expected return, and the initial capital available influence the selection process.

Deposit Option Comparison

A comprehensive comparison of Standard Bank’s fixed deposit options clarifies the benefits and drawbacks of each. This table illustrates the key differences based on tenure, interest rates, and minimum deposit amounts.

| Option | Tenure | Interest Rate | Minimum | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Short-Term FD | 1-6 months | Variable, typically lower than long-term | R1,000 | Liquidity, quick access to funds. Suitable for short-term financial needs. | Potentially lower returns compared to longer terms. |

| Medium-Term FD | 6-12 months | Variable, generally higher than short-term, lower than long-term | R5,000 | Balanced approach; potentially higher returns than short-term, but still accessible within a reasonable timeframe. | Less liquidity than short-term, slightly lower return than long-term. |

| Long-Term FD | 12 months and above | Variable, typically highest amongst the options | R10,000 | Higher potential returns over a longer investment horizon. Suitable for long-term goals like retirement savings or large purchases. | Lowest liquidity; funds are locked in for a longer period. |

Implications of Deposit Term

The length of the deposit term significantly impacts both the potential return and the flexibility of accessing funds.Choosing a shorter deposit term, like a short-term FD, offers greater liquidity, allowing you to access your funds quickly. However, this typically comes with a lower interest rate. This is ideal for short-term goals or when you anticipate needing the funds within a few months.Conversely, a longer deposit term, like a long-term FD, provides the opportunity for higher potential returns.

This is because the interest accrues over a longer period. However, you are locked into the investment for a longer duration. This is suitable for investors who prioritize higher returns and can afford to commit their funds for an extended period. For example, a retiree planning for long-term income might favor a long-term deposit with a high interest rate.

Calculating Returns and Taxes

Understanding the returns on your fixed deposit, along with the tax implications, is crucial for making informed financial decisions. This section delves into the calculations involved, ensuring you have a clear picture of your potential earnings and tax obligations.Calculating your fixed deposit returns involves several factors, primarily the interest rate and the duration of the deposit. Taxation of these returns depends on South African tax laws, and understanding these nuances is key to maximizing your investment’s profitability.

Secure your financial future with enticing STD Bank fixed deposit rates, designed to nurture your savings. Dreaming of a new home in the picturesque landscapes of Troutdale, Oregon? Explore the exquisite options available at homes for sale troutdale oregon. These appealing properties, nestled amongst the natural beauty, are sure to inspire, mirroring the secure growth offered by STD Bank’s fixed deposit rates.

Calculating Total Return

Understanding the calculation is essential to grasp the total earnings from your fixed deposit. The total return is a function of the interest rate and the investment period. A higher interest rate and a longer tenure will lead to a higher return.

Seeking stable returns, consider STD Bank’s fixed deposit rates. A solid investment, these rates, like the burgeoning real estate market in Conception Bay South NL, real estate conception bay south nl , offer promising potential. With careful consideration, your financial future can be secure, just like a well-built home. STD Bank’s fixed deposit rates remain a prudent choice for long-term growth.

Total Return = Principal Amount

- (1 + (Interest Rate

- Tenure))

This formula provides a straightforward approach to calculating the total return. For example, a R10,000 deposit with a 7% annual interest rate held for 2 years would yield a return of R10,000

- (1 + (0.07

- 2)) = R11,400.

Tax Implications on Fixed Deposit Interest

Fixed deposit interest earned in South Africa is subject to income tax. The specific tax rate depends on your individual tax bracket as Artikeld by the South African Revenue Service (SARS). Tax regulations are complex, so it’s recommended to consult a tax advisor for personalized advice.

Sample Calculation, Std bank fixed deposit rates

To illustrate, consider a fixed deposit of R20,000 with a 9% interest rate for a period of 3 years. Applying the formula above:

- Principal Amount: R20,000

- Interest Rate: 9% (or 0.09)

- Tenure: 3 years

Applying the formula:

Total Return = 20,000

- (1 + (0.09

- 3)) = R25,400

The total return on the deposit would be R25,400.

Step-by-Step Guide for Various Scenarios

This section provides a structured approach for calculating returns across different deposit scenarios.

- Determine the principal amount: This is the initial investment amount.

- Identify the interest rate: This is the percentage of return offered on your investment.

- Establish the investment tenure: This represents the duration of the deposit in years.

- Apply the formula: Using the formula above, calculate the total return.

- Consider tax implications: Determine the tax liability based on your individual tax bracket and SARS regulations.

By following these steps, you can calculate the total return and anticipate the tax implications for various fixed deposit scenarios.

Account Opening and Management

Opening a fixed deposit account at Standard Bank is straightforward and generally quick. The process is designed to be user-friendly, allowing you to secure your funds for a predetermined period at attractive rates. Understanding the requirements and procedures ensures a smooth transaction and prevents potential delays. This section Artikels the steps involved in opening, managing, and interacting with your fixed deposit account.

Account Opening Process

The process for opening a fixed deposit account at Standard Bank typically involves visiting a branch or using online banking services. For branch visits, you’ll need to present the required documents and complete the necessary forms. Online applications are often faster and more convenient, allowing you to complete the process from the comfort of your home or office.

Requirements and Documents

To open a fixed deposit account, you’ll need to provide certain identification documents. These vary based on the specific requirements and regulations, but commonly include proof of identity (like a valid South African ID or passport), proof of address (such as a utility bill or bank statement), and proof of your financial capacity (which may be required in certain cases).

Always refer to Standard Bank’s official guidelines for the most up-to-date and complete list of necessary documents.

Online Transaction Steps

Once your account is active, you can use Standard Bank’s online banking platform to manage your fixed deposit account. These platforms offer secure access to your account details, allowing you to monitor balances, track transactions, and initiate online payments. Standard Bank’s online banking portal provides detailed instructions for executing transactions like checking balances, initiating extensions, and making withdrawals.

The specific steps and available features may vary slightly based on the platform version and your account type.

Managing Your Fixed Deposit Account

This section details the procedures for managing your fixed deposit account, including extensions, withdrawals, and other options. Proper management of your fixed deposit is crucial to ensure you receive the agreed-upon interest and avoid penalties.

Extensions

Extending a fixed deposit allows you to maintain the investment for a longer period, potentially capitalizing on favourable market conditions or personal circumstances. Standard Bank offers options for extending your fixed deposit, often with specific terms and conditions. Consult the bank’s official website or contact customer service for the latest details.

Withdrawals

Withdrawals are generally possible before the maturity date, but often come with penalties. Standard Bank’s policy on premature withdrawals Artikels the applicable fees and circumstances. The penalties for early withdrawal can vary significantly based on the deposit term and the reason for the withdrawal. Be sure to understand these policies thoroughly before initiating a withdrawal.

Other Account Management Options

Other account management options, such as checking balances, viewing transaction history, and making payments, are generally available through the Standard Bank online platform or mobile banking app. These tools provide easy access to your account information and streamline the management of your fixed deposit. Consult the bank’s website for details.

Frequently Asked Questions about Standard Bank Fixed Deposits

Navigating the world of fixed deposits can be tricky, but understanding the common questions can make the process smoother. This section addresses frequently asked questions about Standard Bank fixed deposit accounts, providing clear and concise answers.

Understanding Deposit Terms and Conditions

Knowing the specifics of your fixed deposit agreement is crucial. This includes the duration of the deposit, the applicable interest rates, and any associated fees or penalties. Clarity on these terms prevents surprises later.

| Question | Answer |

|---|---|

| What is the minimum deposit amount for a fixed deposit? | Standard Bank typically has a minimum deposit amount, varying depending on the specific deposit product. It’s best to check the current requirements on the Standard Bank website or with a financial advisor. |

| How long can I lock in my funds for a fixed deposit? | Fixed deposit terms are usually set in advance, ranging from a few months to several years. You’ll need to specify the duration when opening your account. |

| Are there any penalties for withdrawing funds before the maturity date? | Early withdrawal penalties are common in fixed deposits. The penalty structure can vary depending on the term and the specific product. Review the terms and conditions carefully. |

| Can I change the interest rate of my fixed deposit after it’s been opened? | Generally, fixed deposit interest rates are set at the time of account opening and are not adjustable. |

Interest Rates and Returns

Understanding how interest rates are calculated and how they affect your returns is important. Different deposit options may have different compounding frequencies and interest calculation methods.

| Question | Answer |

|---|---|

| How are interest rates calculated for fixed deposits? | Interest rates are typically calculated on the principal amount and are compounded at a specified frequency, such as monthly or annually. The specific formula depends on the chosen deposit product. |

| How do market conditions affect fixed deposit interest rates? | Interest rates are influenced by various market factors. Central bank policies, inflation, and overall economic conditions all play a role in determining deposit rates. For instance, a rising interest rate environment might lead to higher deposit rates. |

| How can I compare returns from different fixed deposit options? | Compare fixed deposit options by considering not only the stated interest rate but also the compounding frequency and the deposit term. A longer term might offer a higher effective yield. Tools available on the Standard Bank website can assist in comparing deposit options. |

Account Management and Access

Managing your fixed deposit account and accessing your funds efficiently is essential. Knowing the procedures for updating information or making inquiries is crucial.

| Question | Answer |

|---|---|

| How can I access my fixed deposit information online? | Standard Bank likely provides online access to fixed deposit account information through its banking platform. You can check your deposit balance, maturity date, and other details. |

| How do I make changes to my fixed deposit account details? | Standard Bank likely provides ways to update account details, such as contact information or deposit amounts. Contact Standard Bank’s customer service for assistance. |

| What are the procedures for closing a fixed deposit account? | Closing a fixed deposit account often involves specific procedures and potential penalties, especially if it’s before maturity. Contact Standard Bank for guidance. |

Epilogue

In conclusion, Standard Bank’s fixed deposit rates present a compelling opportunity for secure investment. By understanding the factors influencing these rates and the available deposit options, you can confidently choose the best fit for your financial goals. Remember to consider your individual circumstances and risk tolerance when making your decision. This guide serves as your trusted companion in navigating the world of fixed deposits.

General Inquiries

What are the different types of fixed deposits offered by Standard Bank?

Standard Bank offers various fixed deposit options, each with different tenures and interest calculation methods. These options cater to diverse investment needs and preferences. Information on specific deposit types, including varying tenures and interest calculation methods, is available in the detailed sections.

How do market conditions affect Standard Bank’s fixed deposit rates?

Market fluctuations, such as changes in interest rates and economic conditions, can impact Standard Bank’s fixed deposit rates. Inflation plays a significant role in determining the returns. A detailed explanation of these influences and the relationship between inflation and returns is provided in the corresponding section.

What are the tax implications of earning interest from a Standard Bank fixed deposit?

Interest earned from fixed deposits in South Africa is subject to taxation. Specific details on the applicable tax rates and how to calculate your tax liability are explained in the guide’s section dedicated to returns and taxes.

What are the minimum deposit requirements for different Standard Bank fixed deposit options?

Minimum deposit amounts vary based on the specific fixed deposit type. The guide provides a table outlining the minimum deposit requirements for various options, helping you to choose the most suitable one.