What is a non admitted insurance carrier? They’re the underdogs of the insurance game, operating outside the usual system. Understanding their role, regulations, and potential risks is key for anyone needing insurance.

These carriers often offer different policies and terms, sometimes appealing to those seeking alternatives to traditional providers. But they’re also subject to varying state regulations and consumer protections, so knowing the specifics is vital.

Defining Non-Admitted Carriers

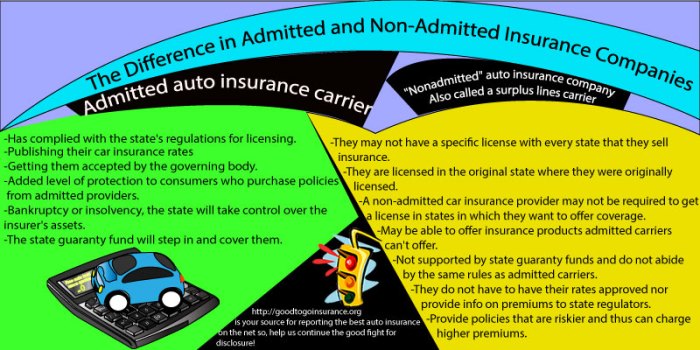

Non-admitted insurance carriers operate outside the regulatory framework of the state in which they are selling policies. This distinct operational approach necessitates a clear understanding of their characteristics and implications. Their presence in the insurance market often involves complexities in terms of consumer protection and regulatory oversight.

Definition of Non-Admitted Carriers

Non-admitted insurance carriers are insurers that do not meet the licensing and regulatory requirements of a specific state. They are not authorized to conduct business within that jurisdiction. This means they lack the state-mandated approvals and oversight that admitted carriers receive. This exclusion often stems from varying state laws, regulatory standards, and capital requirements.

Key Characteristics Distinguishing Non-Admitted Carriers

Non-admitted carriers typically operate in a different manner than admitted carriers, leading to key distinctions. They often employ different distribution channels and may have different financial structures. Crucially, their policies are not subject to the same level of scrutiny and oversight as policies from admitted carriers.

Legal and Regulatory Implications

The legal and regulatory implications of operating as a non-admitted carrier are significant. States maintain the authority to restrict or prohibit the sale of insurance products from these entities. These restrictions frequently stem from concerns about consumer protection, market stability, and ensuring that insurers can be held accountable for their actions. Non-admitted carriers often rely on contractual arrangements and compliance with the laws of the states where they operate.

Comparison of Admitted and Non-Admitted Carriers

| Characteristic | Admitted Carrier | Non-Admitted Carrier |

|---|---|---|

| Licensing Requirements | Meets all state-specific licensing requirements, including capital adequacy and financial soundness standards. This typically involves a detailed application process and rigorous examination of financial stability. | Does not meet the licensing requirements of the state in which it is selling policies. May only operate under specific exceptions or contractual agreements with admitted carriers. |

| Market Access | Has access to the full market within the state, including the ability to sell policies directly to consumers and compete with other admitted carriers. | Access to the market may be limited by state laws. They often operate through specific agreements or broker arrangements to offer policies in a particular state. |

| Regulatory Oversight | Subject to rigorous state regulatory oversight and examinations. State insurance departments monitor their operations, financial solvency, and compliance with state laws. | Regulatory oversight is significantly reduced, or absent, in the state in which they are not admitted. Compliance with state regulations may be limited or nonexistent in that state. |

Market Presence and Operations

Non-admitted insurance carriers present a unique facet of the insurance market, operating outside the regulatory oversight of specific states. Their presence, while often challenging to fully assess, is undeniable. Understanding their market strategies and operational methods is crucial to comprehending the complexities of the insurance landscape.Non-admitted carriers often utilize intricate networks of agents and brokers to access various states’ markets.

This indirect approach, while legally permissible in many cases, necessitates a detailed understanding of state-specific regulations. The effectiveness of this strategy hinges on the carrier’s ability to navigate the intricacies of each state’s insurance code, ensuring compliance with all regulations. Failures to do so can lead to severe penalties and limitations on market access.

Market Penetration Strategies

Non-admitted carriers employ various methods to establish a presence in different states. Direct marketing and advertising are frequently used, although these strategies can vary significantly depending on the carrier’s financial resources and legal standing. A key strategy involves establishing relationships with agents and brokers who are already licensed in the target states. This often proves more efficient than attempting direct marketing campaigns.

The utilization of specialized agents who understand the intricacies of each state’s regulations is also critical to success.

Methods of Operation

Non-admitted carriers typically rely on licensed agents and brokers to facilitate the sale of their policies within a given state. This indirect approach allows the carrier to bypass the direct regulatory oversight of that state, although it also requires adherence to that state’s regulations through the agent or broker. This method requires careful monitoring of agents’ practices to ensure compliance.

Preferred Situations for Non-Admitted Carriers

Non-admitted carriers may be preferred in specific circumstances over admitted carriers. These circumstances often involve specialized or niche products, where the admitted carrier lacks the capacity or expertise. High-risk or unusual situations may also benefit from the flexibility of non-admitted carriers, as they may be more willing to accept risks that admitted carriers are unwilling to undertake. This flexibility, however, comes with the caveat of non-admitted carriers not being subject to the same regulatory oversight as admitted carriers.

Coverage Acquisition Procedures

The procedure for non-admitted carriers to obtain coverage in a specific state is complex and varies from state to state. Each state has its own set of rules and regulations regarding the licensing and approval of insurance companies. Compliance with these requirements is crucial to avoid legal challenges and ensure proper market access. In essence, non-admitted carriers must carefully assess each state’s specific requirements to avoid operational problems.

Non-Admitted Insurance Products and State Regulations

| Type of Non-Admitted Insurance Product | Typical State Regulations |

|---|---|

| Specialty insurance (e.g., professional liability, surety bonds) | Regulations often focus on the specific risks involved, requiring detailed underwriting and compliance with the state’s licensing requirements. |

| Short-term insurance | States often have specific guidelines for short-term policies, including duration limits, and require adherence to the state’s requirements for coverage amounts and claims handling procedures. |

| Excess and surplus lines insurance | States typically have specialized regulations for excess and surplus lines, as these policies often cover higher risks or coverages not available from admitted carriers. These regulations often center on the criteria for determining when a carrier is eligible for surplus lines market access. |

| High-risk insurance | High-risk insurance is frequently governed by strict regulations, as these policies may cover hazardous activities or entities with an elevated risk profile. The criteria for determining eligibility often involve detailed risk assessments and adherence to state-specific standards. |

Consumer Protection and Risks

Non-admitted insurance carriers, operating outside the regulatory framework of a particular state, pose significant consumer protection concerns. Their lack of oversight by state insurance departments leaves consumers vulnerable to various risks, ranging from fraudulent practices to outright insolvency. Understanding these vulnerabilities and the steps consumers can take to mitigate them is paramount.Consumers dealing with non-admitted carriers face a heightened risk of inadequate or nonexistent claims handling.

The absence of regulatory oversight often means these carriers are not subject to the same standards of conduct as admitted carriers, potentially leading to delayed or denied claims, poor service, and ultimately financial hardship for policyholders. The lack of regulatory oversight also makes it more difficult for consumers to resolve disputes.

Potential Consumer Protection Concerns

State insurance departments play a crucial role in protecting consumers from fraudulent or irresponsible non-admitted carriers. Their regulatory oversight ensures that admitted carriers adhere to established standards and consumer protections. However, the absence of this oversight for non-admitted carriers can lead to significant consumer vulnerabilities. Consumers may be presented with policies that do not meet the standards required by the state where they reside.

This lack of compliance may lead to significant difficulties in the event of a claim.

Risks Faced by Consumers

Consumers dealing with non-admitted carriers are exposed to a variety of risks. These include the potential for fraudulent practices, such as the carrier disappearing with collected premiums before providing coverage. The lack of state-level oversight makes it more challenging for consumers to verify the legitimacy of the carrier and the validity of their policies. Consumers may also find it difficult to pursue legal action in case of a dispute, as non-admitted carriers may not be subject to the same legal requirements as admitted carriers.

Role of State Insurance Departments

State insurance departments act as a critical safeguard for consumers against unscrupulous non-admitted carriers. Their role includes ensuring compliance with state laws and regulations, investigating consumer complaints, and taking enforcement actions against carriers that violate those laws. They play a key role in protecting consumers by investigating potential fraud and issuing warnings when appropriate. Furthermore, state insurance departments provide resources and information to help consumers evaluate the legitimacy of insurance carriers.

A non-admitted insurance carrier, essentially, operates outside the established regulatory framework of a specific jurisdiction. This often means they don’t hold the same level of financial security as admitted carriers, which can sometimes be a factor when considering a purchase. A prime example of a place where such factors might be important is in the context of insuring a property like a 1 bedroom apartment with den, especially when the den is a key selling point.

Ultimately, understanding the nuances of non-admitted carriers is crucial for responsible property ownership.

Common Consumer Complaints

Common complaints regarding non-admitted carriers include:

- Delayed or denied claims processing.

- Inadequate policy explanations and unclear coverage.

- Failure to fulfill contractual obligations.

- Non-responsive customer service.

- Insolvency of the carrier before a claim is settled.

These complaints highlight the significant risks associated with dealing with non-admitted carriers.

Filing a Complaint

Filing a complaint against a non-admitted carrier involves contacting the appropriate state insurance department. The department will provide guidance on the complaint process and investigate the issue. Consumers should meticulously document all communications, policy details, and relevant dates.

Researching and Verifying Legitimacy

Consumers should thoroughly research the legitimacy of any non-admitted carrier before purchasing a policy. Reputable resources include the state insurance department website, independent consumer reporting agencies, and industry watchdogs. A quick search online for complaints and reviews can help consumers evaluate the carrier’s reputation and reliability.

Verifying Carrier License and Standing

The following table Artikels the steps consumers can take to verify the license and standing of a non-admitted carrier:

| Step | Action |

|---|---|

| 1 | Verify the carrier’s license with the state insurance department. |

| 2 | Check for any public complaints or warnings issued by the insurance department. |

| 3 | Consult independent consumer reporting agencies for information on the carrier’s reputation. |

| 4 | Review online reviews and forums for feedback from previous customers. |

| 5 | Assess the carrier’s financial stability through available resources. |

Consumers should be vigilant and take necessary steps to protect themselves when considering non-admitted carriers.

Insurance Products Offered

Non-admitted insurance carriers, operating outside the regulatory framework of admitted carriers, often present a unique landscape of insurance products. Their offerings frequently differ in terms of coverage, benefits, and regulatory oversight, posing potential risks for consumers. Understanding these nuances is crucial for informed decision-making.

Types of Insurance Products Offered

Non-admitted carriers frequently offer a variety of insurance products, including but not limited to property insurance, liability insurance, and specialized commercial insurance. These products may address specific market niches or underserved segments.

Coverage and Benefits Differences

Coverage and benefits provided by non-admitted carriers can differ significantly from those offered by admitted carriers. Non-admitted carriers may provide coverage for similar risks, but the scope and limits may vary considerably. For example, while both admitted and non-admitted carriers might offer auto insurance, the specific perils covered, the policy limits, and the types of vehicles insured might differ.

This necessitates careful scrutiny of policy language and potential exclusions. Furthermore, non-admitted carriers often utilize different underwriting standards, which can affect the likelihood of claims approval and the overall cost of the policy.

A non-admitted insurance carrier operates outside the regulatory framework of a specific state. This often means navigating a complex landscape of varying rules and regulations, which can impact your insurance options, especially when considering rentals like those available at Lakeview Terrace Apartments Augusta GA. Ultimately, understanding the nuances of non-admitted carriers is crucial for making informed decisions about insurance coverage.

Policy Terms and Conditions

Terms and conditions for non-admitted insurance policies can also deviate from those of admitted carriers. Non-admitted carriers might have different policy durations, renewal terms, or claim handling procedures. Furthermore, the enforcement of these terms and conditions may differ in the absence of state regulatory oversight. Consumers should meticulously review policy documents for details concerning dispute resolution mechanisms and the potential for challenges in navigating claim processes.

Examples of Products in Specific Sectors

In the construction sector, non-admitted carriers might offer specialized contractor’s liability insurance catering to unique job site risks. In the transportation industry, non-admitted carriers might provide specialized trucking insurance addressing specific operational needs and risks. The availability of such niche products is often a result of the market’s particular demands and needs.

Table Summarizing Insurance Products and Regulatory Considerations

| Insurance Product | Regulatory Considerations |

|---|---|

| Property Insurance | Varying state regulations regarding coverage limits, policy forms, and claims procedures. Compliance with state laws regarding insurable interests and insurable perils is critical. |

| Liability Insurance | Differences in coverage, exclusions, and policy limits exist. Scrutiny of the carrier’s financial strength and claims-paying ability is essential. |

| Commercial Insurance (e.g., professional liability) | Specific licensing and regulatory requirements might apply, particularly in high-risk industries. Reviewing the carrier’s compliance with industry standards and licensing is vital. |

| Specialized Insurance (e.g., surety bonds) | Stricter regulatory oversight in certain jurisdictions might be present. Verification of the carrier’s financial stability and adherence to surety bond regulations is crucial. |

Regulatory Landscape: What Is A Non Admitted Insurance Carrier

Non-admitted insurance carriers operate under a complex and often state-specific regulatory environment. Strict adherence to these regulations is paramount for maintaining legitimacy and consumer trust. Failure to comply can result in severe penalties, impacting the carrier’s ability to operate effectively. Understanding the regulatory framework is critical for these carriers to navigate the marketplace successfully.

Regulatory Environment for Non-Admitted Carriers

The regulatory landscape for non-admitted carriers is primarily determined by individual state insurance departments. This decentralized approach often leads to variations in requirements and compliance standards across different jurisdictions. Uniformity is lacking, creating challenges for carriers operating in multiple states. The lack of a national standard for non-admitted carriers necessitates meticulous research and compliance efforts in each state where the carrier intends to operate.

Different Regulations and Laws Governing Non-Admitted Carriers

Regulations governing non-admitted carriers encompass various aspects of their operations. These regulations typically include provisions concerning licensing requirements, financial solvency standards, reporting obligations, and specific rules pertaining to the types of insurance products they can offer. Significant attention is needed to understand the nuances of each state’s regulations. Failure to meet these varied requirements can lead to severe repercussions.

Licensing and Compliance Requirements

Licensing and compliance requirements for non-admitted carriers are substantial and complex. Carriers must obtain the necessary licenses in each state where they intend to conduct business. These licenses often come with stringent conditions, including maintaining adequate financial resources and adhering to specific reporting protocols. Maintaining detailed records of compliance actions is vital to demonstrate adherence to regulations.

Failure to comply with licensing requirements can lead to immediate suspension or revocation of operating licenses.

Penalties for Non-Compliance with Regulations, What is a non admitted insurance carrier

Penalties for non-compliance with insurance regulations can be substantial and detrimental to the carrier’s financial stability and operational capacity. These penalties can range from fines to the suspension or revocation of licenses, ultimately jeopardizing the carrier’s ability to operate in the affected states. The financial ramifications of non-compliance can be severe, highlighting the importance of proactive regulatory compliance.

For instance, significant fines can quickly erode profitability.

Role of State Insurance Departments in Regulating Non-Admitted Carriers

State insurance departments play a critical role in regulating non-admitted carriers within their respective jurisdictions. These departments oversee the licensing process, monitor compliance, investigate complaints, and ensure that carriers maintain adequate financial resources to fulfill their obligations. Their actions directly impact the stability and legitimacy of the insurance market. Their presence is crucial for protecting consumers and maintaining the integrity of the insurance industry.

Regulatory Frameworks of Different States

The regulatory frameworks for non-admitted insurance carriers vary significantly from state to state. The requirements and procedures differ, making it crucial for carriers to meticulously research and understand the specific regulations of each state where they operate. This intricate landscape necessitates a comprehensive understanding of the unique regulatory environment for each jurisdiction. A detailed comparison is shown in the table below.

This illustrates the significant variation in regulatory frameworks.

| State | Licensing Requirements | Financial Solvency Standards | Reporting Obligations |

|---|---|---|---|

| State A | Complex, multi-step process | High capital requirements | Detailed and frequent reporting |

| State B | Simplified, streamlined process | Lower capital requirements | Less frequent reporting |

| State C | Hybrid approach | Moderate capital requirements | Semi-frequent reporting |

Insurance Claim Procedures

Filing claims with non-admitted carriers presents unique challenges and complexities. Unlike admitted carriers, which are licensed and regulated within a specific jurisdiction, non-admitted carriers operate outside these frameworks. This often results in less transparency and potentially slower claim settlement processes. Understanding these differences is crucial for consumers to navigate the claim process effectively.Claim procedures for non-admitted carriers can vary significantly, making it essential for consumers to thoroughly understand the specific details Artikeld in the policy documents.

Consumers must meticulously document all aspects of the claim, including supporting evidence, to ensure a smooth and efficient resolution. This proactive approach minimizes potential delays and disputes.

Claim Filing Process Overview

The process for filing a claim with a non-admitted carrier typically begins with contacting the carrier directly, as Artikeld in the policy documents. Crucially, the insured should meticulously document all correspondence, including dates, times, and names of individuals contacted. This documentation is essential for tracking the progress of the claim and for future reference. The claim should be filed in accordance with the carrier’s specific procedures, Artikeld in the policy.

Policy details should be consulted thoroughly to avoid miscommunication or procedural errors.

Claim Settlement Timeframes and Procedures

Non-admitted carriers often have unique claim settlement timeframes that may differ substantially from those of admitted carriers. The timeframes are typically specified in the policy, and the insured should meticulously review these stipulations. Failure to adhere to these stipulations may lead to delays or rejection of the claim. Consumers must diligently follow the established procedures, including any required documentation or inspections, to ensure a timely settlement.

Settlement procedures should be reviewed carefully to avoid potential misunderstandings or disputes.

Comparison of Claim Handling Processes

Admitted and non-admitted carriers differ significantly in their claim handling processes. Admitted carriers operate under strict regulatory oversight, ensuring a more standardized and transparent process. Non-admitted carriers, operating outside these frameworks, may lack the same level of oversight, potentially leading to inconsistencies in claim handling. This disparity can significantly impact the efficiency and effectiveness of the claim settlement process.

Consumer awareness of these differences is paramount.

Non-Admitted Carrier Claim Process Table

| Step | Description | Timeline (Estimated) |

|---|---|---|

| 1. Claim Initiation | Contacting the carrier, gathering necessary documentation (policy details, supporting evidence). | Within 24-72 hours of incident |

| 2. Claim Assessment | Carrier evaluates the claim, potentially requiring additional information or inspections. | 1-4 weeks |

| 3. Negotiation/Dispute Resolution | Negotiation or dispute resolution if necessary, in accordance with the policy. | Variable; dependent on complexity |

| 4. Claim Settlement | Payment of the claim, in accordance with the policy terms. | 1-6 weeks (or longer depending on complexity) |

| 5. Claim Closure | Final documentation and confirmation of claim settlement. | Within 2-4 weeks of settlement |

Note: These timelines are estimates and may vary significantly based on the complexity of the claim, availability of documentation, and the specific carrier.

End of Discussion

In short, non-admitted carriers are a complex part of the insurance landscape. Their presence offers choices, but navigating the varying regulations and potential risks is crucial for consumers. Armed with knowledge, you can make informed decisions.

Question Bank

What are the key differences between admitted and non-admitted carriers?

Admitted carriers are licensed and regulated by state insurance departments. Non-admitted carriers operate outside these regulations, often facing less stringent requirements, though this often comes with fewer consumer protections.

How can consumers verify the legitimacy of a non-admitted carrier?

Check with the relevant state insurance department. Look for licensing information and any complaints filed against the company. Online resources and consumer reporting agencies can also help.

What are the potential risks for consumers dealing with non-admitted carriers?

They might have less consumer protection if things go wrong. You might have a tougher time resolving claims, and in extreme cases, the company could disappear without notice. Thorough research is crucial.

What types of insurance products do non-admitted carriers typically offer?

Often, they offer niche or specialty products, like certain types of property insurance, or insurance for businesses with specific needs. They might also provide policies that aren’t readily available from admitted carriers.